The Real Impact of the Inflation Reduction Act

Interested in the IRA?

Visit our Inflation Reduction Act page for more, including:

The far-reaching implications of the Inflation Reduction Act (IRA) can’t be stressed enough. It’s more than a piece of legislation, it’s a blueprint for a new America designed by passionate leaders determined to make a difference. The IRA provides $8.8 billion in rebates for home energy efficiency and electrification projects to ensure that no communities are left behind in the transition to a clean energy future1.

The IRA’s two initiatives, the HOMES Rebate Act and the High-Efficiency Electric Home Rebate Act (HEEHRA), will make these funds available to every household via home energy rebates. As part of the White House's Justice40 Initiative, these two programs ensure that 40% of the overall benefits of the IRA’s clean energy investments help communities that are energy burdened and historically under-resourced. It's estimated these new home energy rebates will save people $1 billion annually in energy costs2.

How are home energy rebates determined?

The rebate amounts are determined by the Area Median Income (AMI) and broken down in the table below3. More funds are available for households below 150% AMI and below 80% AMI, but it’s important to note these rebates aren’t income capped.

| Type of Home Energy Project | Maximum Allowed Rebate Amount Per Household Below 80% Area Median Income (AMI) | Maximum Allowed Rebate Amount Per Household Above 80% Area Median Income (AMI) |

| Home Efficiency Project with at least 20% predicted energy savings | 80% of project costs up to $4,000 | 50% of project costs up to $2,000 (maximum of $200k for a multifamily building) |

| Home Efficiency Project with at least 35% predicted energy savings | 80% of project costs up to $8,000 | 50% of project costs up to $4,000 (maximum of $400k for a multifamily building) |

| Home Electrification Project Qualified Technologies (only households with an income below 150% AMI are eligible) | 100% of project costs up to technology cost maximums*; up to $14,000 | 50% of project costs up to technology cost maximums; up to $14,000 (households with incomes above 150% AMI are not eligible) |

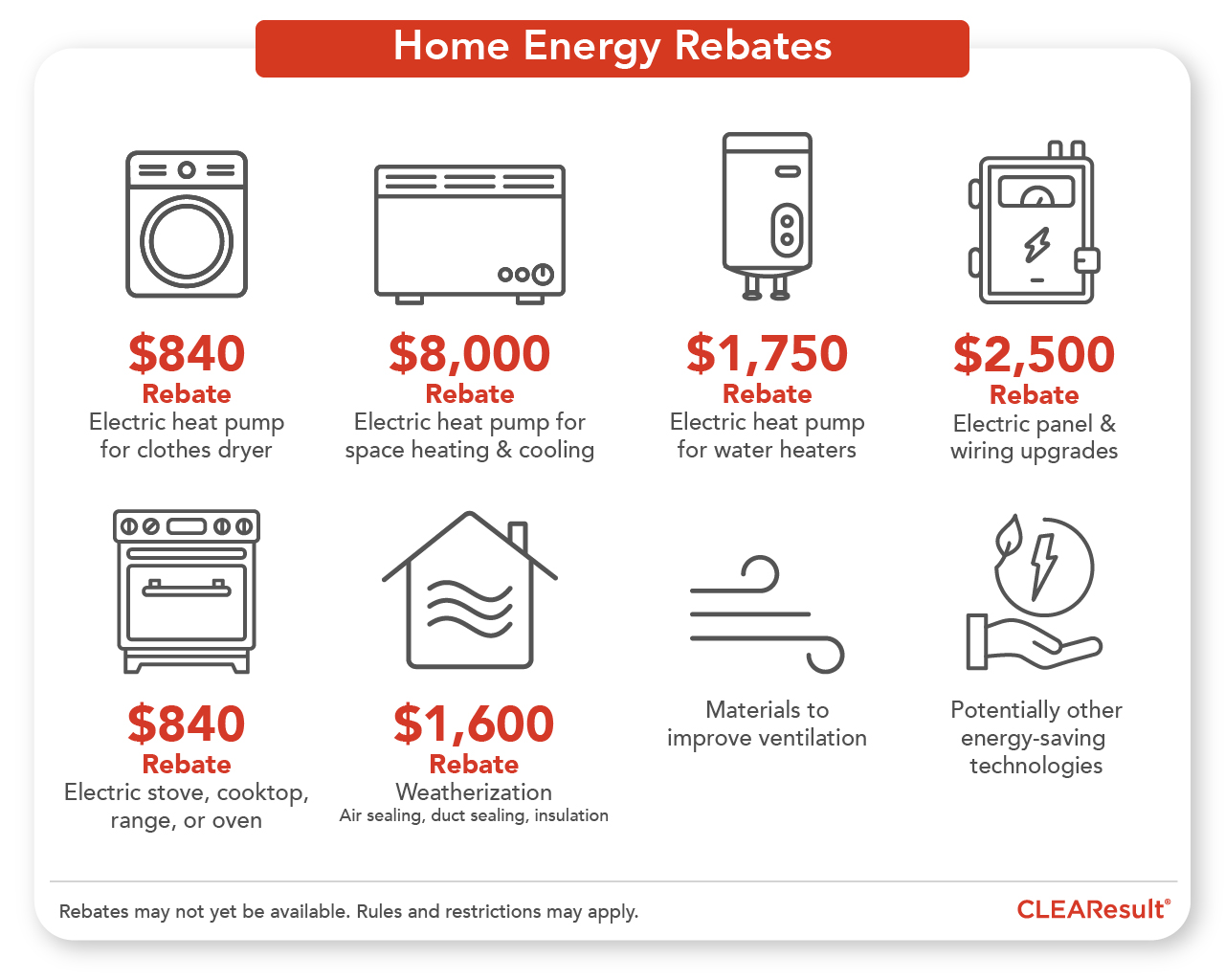

What types of products can these rebates be applied to?

The home energy rebates can be applied to:

- Electric heat pump clothes dryer

- Air sealing

- Electric heat pump for space heating and cooling

- Duct sealing

- Electric heat pump water heaters

- Insulation

- Electric panel & wiring upgrades

- Materials to improve ventilation

- Electric stove, cooktop, range, or oven

- Potentially other energy-saving technologies

Where applicable, technologies must be certified under the EPA’s ENERGY STAR program.

What does this mean for my household?

The best way to bring to life the benefits of the IRA is by drilling down into the details. When we breakdown how much people can save, the life-changing impacts are even more evident. For many of America’s most vulnerable households, these home energy rebates will help free-up cash usually set aside for energy bills. A little extra money each month can go a long way to providing people more peace of mind. Let’s look at a few illustrative examples of how the IRA’s home energy rebates come into play for different households. Plus, check out this useful calculator that allows you to enter in your own details for a more accurate picture.

Are home energy rebate funds available?

Not yet. Once the Department of Energy has made funds available to states and Indian Tribes, those entities will then be responsible for setting up and administering programs.

What should I do now to prepare?

Your first step should be to look up the AMI for your location. This piece of information directly determines the amount you can receive in home energy rebates. For households with a total annual income less than 150% of the AMI, home electrification rebates may cover up to 100% of a total qualified project’s cost.

Next, schedule an energy audit of your home for guidance on how to make it more energy efficient. It’s worth checking with your local utility to see if you qualify for a free energy audit or one at a reduced cost.

Lastly, start talking with contractors to line them up for projects when the rebates and tax credits become available. Educating yourself about the types of equipment necessary for your own house can give contractors a better idea of how to approach your project. Many utilities also offer services and/or programs that can even connect you with qualified contractors and trade allies.

How we can help.

Our energy experts and clients are always looking out for the planet and people. As more information about the IRA is released, we’ll be updating our resource page regularly. Bookmark it for the latest news and facts on this historical piece of legislation.

____________

1https://www.energy.gov/scep/slsc/home-energy-rebate-programs

3https://www.energy.gov/scep/home-energy-rebate-programs-frequently-asked-questions