Deciding where to focus utility electrification efforts

Electrification is a key component in our decarbonization efforts, and has tremendous potential across many applications. But what applications should utilities with limited time and resources focus on for the best outcomes? The factors that determine success, and the questions utilities should ask themselves, can be categorized as follows:

- Customer adoption favorability: How open are customers to change?

- Regulatory favorability: Are regulations supporting electrification?

- Maturity of technology: Is there an existing and proven technology solution?

- Market potential: How common is the opportunity to switch from current systems?

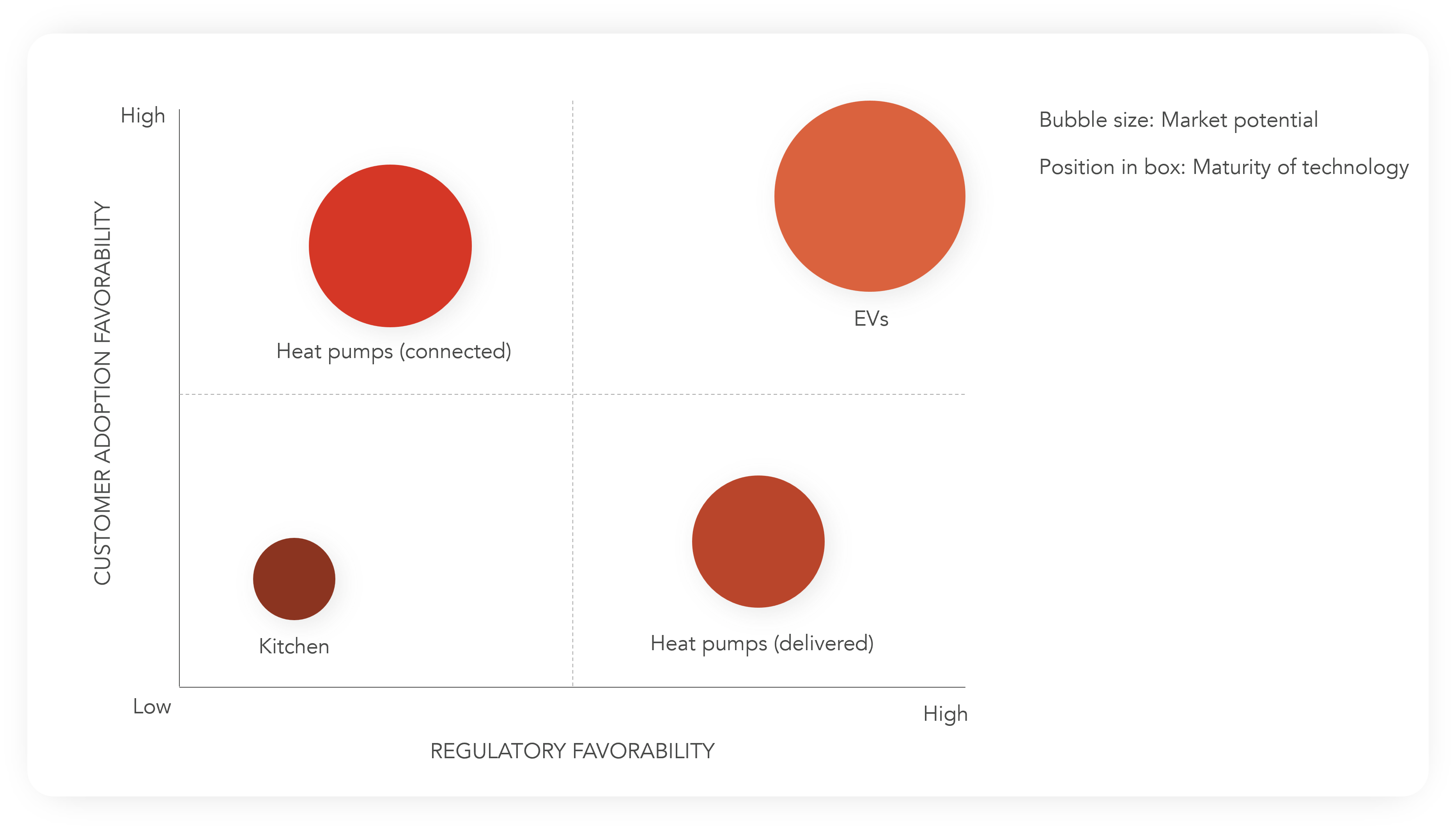

Charting electrification opportunities

If we use a quadrant chart to consider these four factors for a residential setting, we can begin to see where opportunities lie. The graph below represents EVs, kitchen electrification and heat pumps, separated into delivered (oil or propane) and connected (natural gas) fuel systems. The graph below represents electric vehicles (EVs), kitchen electrification and heat pumps, separated into delivered (oil or propane) and connected (natural gas) fuel systems. These are plotted against customer and regulatory favorability. Placement in the quadrant represents the maturity of technology and the size of the bubble represents market potential. We are generally aiming for high regulatory and customer favorability. Note, space heat pumps have more mature technology than water heat pumps. For simplicity’s sake we have combined them here. Let’s dig deeper into what this means for the four electrification opportunities presented.

Electric vehicles: run, don’t walk

Electric vehicles (EVs) are now widely adopted in many regions, driven by substantial growth in consumer interest and governmental and private sector investment. The demand for EVs is supported by regulations, policies, tax incentives and advancements in battery technology. Electric light-duty vehicles (LDVs), primarily used for residential purposes, are projected to comprise 40% of LDV sales in the U.S. and 60% in Canada by 2030 40% of LDV sales in the U.S. and 60% in Canada by 2030 (source: International Energy Agency).

For utilities, incorporating EVs into current and future planning is essential. EV growth presents unique challenges and opportunities for grid management. Utilities can manage demand by delivering incentives to charge during off-peak hours, flattening the load curve and making the grid more stable and efficient. Utility companies, backed by government policy and technological advancements, have also been increasing their investment in related energy storage and vehicle-to-grid (V2G) applications. Early pilots are now demonstrating how EVs can act as distributed energy storage units, providing backup power and stabilizing the grid during peak demand times or outages through V2G technologies.

Heat pumps: it depends (on existing systems and rules)

Heat pumps have seen significant adoption but are not the best choice for all homeowners. While they can reduce greenhouse gas emissions (GHGs), they come with higher upfront costs. These costs can be offset by tax and program incentives, but savings are not always guaranteed. The potential of heat pumps greatly depends on the existing fuel delivery system.

Delivered fuels: Programs serving residences using delivered fuels like propane or oil have fewer regulatory barriers but may face some challenges with consumer favorability. Regulations governing fuel-switching typically pose few barriers to installation of high-efficiency electric alternatives to heating oil and propane. However, it is generally simpler and less expensive to replace an oil or propane system rather than opt for the more complex and costly installation of a heat pump. On system. On the plus side, transitioning to electric heat pumps can reduce operational costs significantly, especially in regions with high fuel prices and stable electricity rates. Transitioning from delivered fuel systems also has a more positive emission impact than transitioning from connected systems, making some customers more willing to take on the complexity of electrification.

- Connected systems: Heat pumps in homes with connected systems are popular among customers but face more regulatory challenges. They must comply with various regulations, including energy efficiency, building codes, grid interconnection, environmental impact, utility regulations, product labeling and electrical safety standards. Programs promoting the switch from natural gas to electricity for heating may be prohibited in many areas. In states where fuel-switching is allowed, tests for cost-effectiveness and other factors create additional barriers. However, the market potential to switch from connected natural gas is greater than with delivered fuels, such as fuel oil, as there are many more households in the U.S. connected to natural gas (51%) than use delivered fuels like propane or fuel oil (4%) (source: EIA).

- Customer interest in heat pumps is rising and utilities can meet their customers by offering education and tools to help them determine whether heat pumps are the best solution for them. CLEAResult ATLAS™ Heat Pump Calculator allow customers to input their current system specifications to explore transition scenarios and make the most informed decision for them. CLEAResult ATLAS™ Heat Pump Calculator allows customers to input their current system specifications to explore transition scenarios and make the most informed decision for them. For those interested, some jurisdictions are open to fuel-switching measures, so utilities should understand the current rules in their region to see if they meet the necessary requirements.

Kitchen electrification: keep on the back burner

Kitchen electrification faces significant challenges in both customer adoption and regulatory requirements. High transition costs, strong consumer preferences for gas cooking and the need for substantial electrical upgrades present major barriers. Older homes may also require significant electrical upgrades to support the increased load from electric kitchen appliances, including updating wiring, circuit breakers and the main electrical panel, which can be costly and complex.

Further, policies specifically promoting kitchen electrification are not as advanced or as widespread as those for other electrification efforts. This slower policy development means fewer regulatory drivers encouraging the transition to electric kitchens. Despite the well-documented health and carbon-reduction benefits of all-electric kitchens, widespread market adoption is likely to lag other opportunities to decarbonize.

For now, utilities should focus on consumer education and demonstrations, and support long-term market transformation strategies for kitchen electrification.

In summary, utilities should prioritize their electrification efforts on electric vehicles (EVs) and heat pumps. These areas show high customer and regulatory favorability, advanced technology maturity and significant market potential.